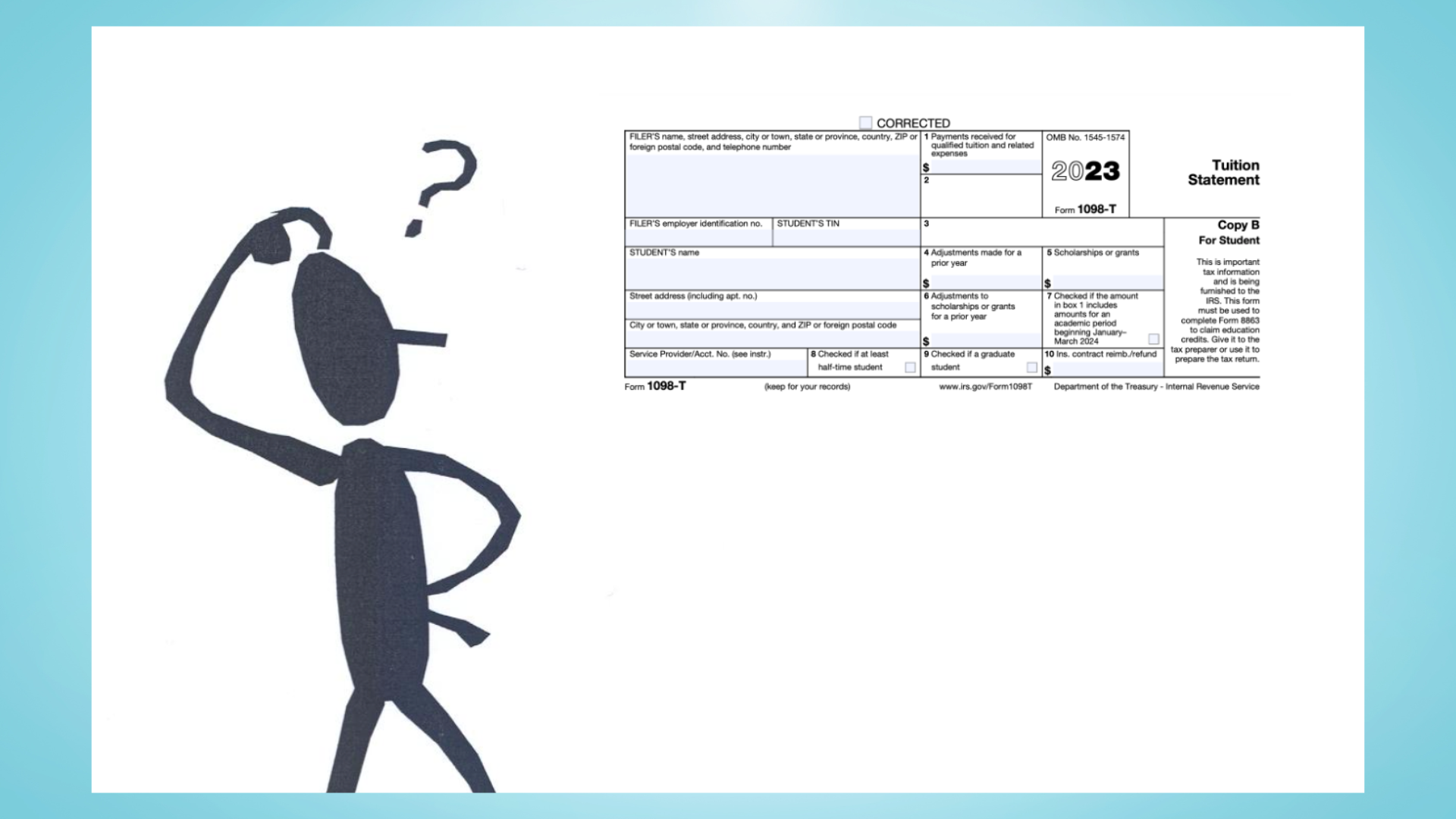

Although every student receives this form, many questions surround this tax form such as what is it exactly? What is it used for? Why is it issued in the first place? Art by Joseph Sanker.

By Joseph Sanker, Staff Reporter

The 1098-T Tuition Statement is a tax form that a college or university sends to the federal government informing them on how much a student has paid in tuition for that tax year.

Stephen Kennedy, the owner of the tax preparation and consultation business Kennedy Tax Service and who has serviced the people of the Los Angeles area for decades, explained why.

“They send it out to the students so they can put it on their taxes, get credit on their taxes and get a refund for their credit,” Kennedy said. “If you receive the form 1098-T you can take it to the person that is doing your taxes, have them put it on your taxes and get a [refund for] the tuition that you pay.”

However, the tax credit only applies to the student’s taxes if their financial aid is less than the tuition they paid. Meaning if the student’s financial aid is more than the tuition that they paid for the university then they do not qualify for the refundable tax credit.

“If their tuition is $10,000 and the financial aid is $5,000, they are able to receive a tax credit of $5,000,” Kennedy explained.

A tax credit, as defined by L.A.-based law firm Bartley Law Office, is a “dollar-for-dollar reduction of the income tax you owe,” meaning whatever the student owes in taxes, based on the total income that they made for that year, will be reduced because they have a refundable tax credit for attending college or university. Kennedy said that “(The refund) they receive will be determined by how much income they made that year.”

An example of this would be if a student made $20,000 last year and reported it on their taxes they would “get back a pretty good amount,” according to Kennedy. “It’s hard to say until I actually do the tax, but an estimated guess would be around $2,000.”

A student with no job or income is also encouraged to include their 1098-T form in the filing of their taxes as there is a potential for a sizable return.

“I think a person with no income will get back around $1,000 but I will have to look at their taxes and see,” Kennedy said “You still could qualify for the [tax] credit.”

If a student does not wish to use their 1098-Tax form, one can still file their taxes without that form as it is not a mandatory form for a student to file.

“You can file your taxes without it, it’s not mandatory that you take the credit but if you have the 1098-T you’d want to get the credit cause it’s a refundable credit that comes back to you,” Kennedy said.

The 1098-T Tax Form is now available in California State University, Dominguez Hills student center portals. Students who have not received a form in their student center are encouraged to contact the financial aid office.